Zambia’s recent efforts to restructure its debt have dominated headlines. But what exactly is debt restructuring, and why is it such a critical issue for the country? Is this same restructuring a lifeline or a band-aid?

In layman’s terms, debt restructuring allows a nation, like Zambia, to renegotiate its loans with creditors to make them more manageable. This can involve extending repayment periods, lowering interest rates, or even reducing the total amount owed.

Why Does It Matter?

A nation drowning in debt resembles an individual struggling to pay basic bills. A person in such a situation cannot afford to pay for basic necessities like food and decent shelter. Groceries become a luxury while keeping the lights on or their car running (if they can afford one), a mammoth task. This constant financial strain leaves them with no room to breathe, let alone invest in their future. They can’t afford to go back to school for a better job or fix the leaky roof, further limiting their ability to climb out of this financial hole.

The same is true for a nation. When debt becomes overwhelming, essential investments in infrastructure, healthcare, and education suffer. This lack of investment hinders economic growth, trapping many Zambians in poverty.

A Historical Perspective from Relief to Accumulation

Zambia’s current predicament is even more concerning considering its past success. Debt relief initiatives like HIPC and MDRI significantly reduced Zambia’s debt from a staggering $7.2 billion to a manageable $2.5 billion in 2008.

However, by 2012, debt began to surge again. The government secured loans for various sectors like health, transportation, and education. Additionally, a $1 billion Eurobond issued in 2014 marked a sharp rise in the debt stock. By 2019, Zambia had accumulated significant commercial debt, with China and Eurobonds becoming major creditors.

A JCTR 2020 study also identifies domestic political decisions, policy choices, and potential misuse of loans as significant contributors to the current crisis.

A Nation in Over its Head

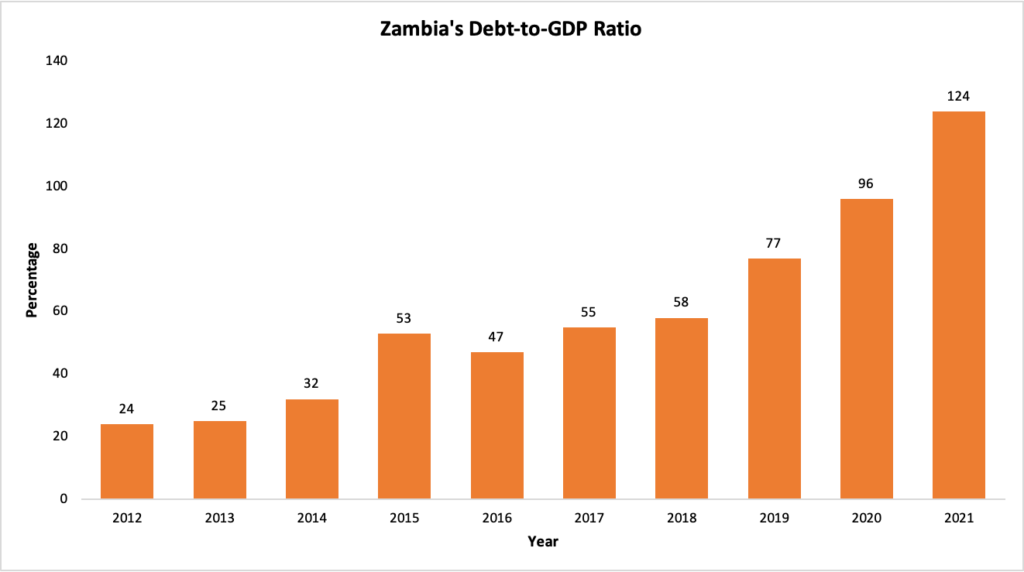

The IMF and World Bank recommend a sustainable debt-to-GDP ratio of around 35% for Zambia. Unfortunately, the country’s ratio stands at a staggering 124%, a concerning 89% above the recommended threshold. This unsustainable situation highlights the urgency of debt restructuring.

Going by the recommended ratio, the picture below makes for a sad reading.

Zambia’s Debt-to-GDP Ratio

The Human Cost of Debt

Debt isn’t just a financial burden; it carries real-world consequences. When a significant portion of government resources goes towards debt repayment, crucial social services face neglect. This lack of investment in healthcare, education, and infrastructure directly impacts the lives of Zambians, hindering their well-being and economic prospects.

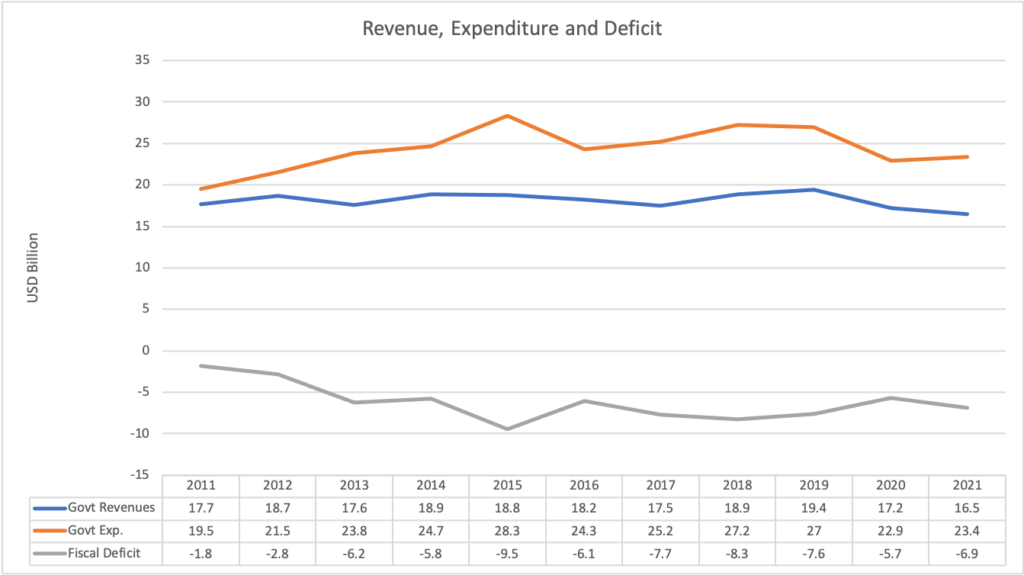

Zambia’s revenue situation has been a rollercoaster ride, not a steady climb. Imagine a farmer whose harvest bounces wildly from year to year, with the best year barely reaching $19.4 billion in 2019. But that good fortune was fleeting, plummeting to a record low of $16.5 billion just two years later. Meanwhile, the government’s spending habits resembled a bottomless pit, consistently exceeding what they brought in. This constant overspending, like a leaky bucket, left them running a fiscal deficit throughout the entire period, digging Zambia deeper and deeper into debt.

Zambia’s Revenue, Expenditure and Deficit between 2011 and 2021

A Path to Recovery

Debt restructuring offers Zambia a chance to renegotiate loans and make them more manageable. This could free up resources for critical investments in the country’s future. However, it’s important to remember that debt restructuring is a step, not a solution. We have a lot of work to do ahead to bring the country back on track.

Using the freed-up resources, for instance, we can put priority on projects that can generate revenue for the country. This means learning from our past and avoiding funding projects like roads that have little economic value in the grand scheme of things. Enterprise development must be at the top of our development agenda. We need to expand investments into building structures that support and encourage local business growth.

Lessons from Success Stories: Argentina, Uruguay, and the DRC

Countries like Argentina, Uruguay, and the DRC have successfully used debt restructuring to overcome economic crises and achieve growth. As a case in point, In 2001, Argentina faced a massive economic crisis due to heavy debt. After a complex restructuring process, they managed to reduce their debt burden and eventually return to economic growth. Similarly, Uruguay underwent a successful debt restructuring in the early 2000s. This allowed them to stabilise their economy and attract foreign investment.

On the continent, the DRC achieved significant debt relief through a multilateral agreement in 2010. This freed up resources for poverty reduction and economic development. These are just a few examples, and each country’s situation is unique. However, they all demonstrate the potential of debt restructuring as a tool for overcoming financial challenges, offering a glimmer of hope for Zambia.

A Challenge for Posterity

The road to recovery won’t be easy. To avoid future debt crises, Zambia must diversify its economy and expand its revenue base. While the recent debt restructuring agreements are a positive step, long-term solutions require a commitment to responsible fiscal policies and economic development

Zambia’s recent debt restructuring isn’t a magic solution, but it’s a critical lifeline for a nation on the brink. Drowning in debt, this restructuring throws Zambia a much-needed life preserver, giving the country a fighting chance at regaining financial stability.

But, let’s not pop the champagne just yet. While this restructuring is certainly cause for cautious optimism, it’s just the first step on a long road to recovery. Future articles will delve deeper into the complexities of Zambia’s situation. For now, let’s acknowledge the positive development and the opportunity it presents.

The path forward won’t be a walk in the park. To avoid falling back into a debt trap, Zambia must diversify its economy and find new sources of revenue. The recent agreements are a positive step, but long-term success hinges on responsible fiscal policies that prioritise sustainable economic development. This, my friends, is the true challenge for Zambia – a challenge for posterity. It requires a long-term commitment to building a stronger, more resilient economy for future generations.

- 13 Life Lessons I Learnt as a Teacher - July 23, 2024

- 13 Life Lessons I Learnt as a Teacher - July 22, 2024

- 13 Life Lessons I Learnt as a Teacher - July 21, 2024

Well articulated! Looking forward to reading the next one!

Don’t you think kind of restructuring might affect your grandchildren maybe even your children. (I mean the future)

It definitely will. That is why we should do our best to borrow within our means. Otherwise, we badly affect posterity.