Like a responsible parent guiding a child on a journey, the central bank plays the crucial role of protector of our wealth in the country. The Bank of Zambia (BOZ) acts as a guardian, ensuring a stable and prosperous financial future for all Zambians. In this article, I explore how the Bank of Zambia is the guardian of our wealth.

The Pillars of Financial Security

In the same way a caring parent sets clear rules for responsible financial behaviour, the central bank acts as the cornerstone of a nation’s financial system, focusing on three key areas to keep the financial system healthy:

- Maintain price stability- This involves controlling inflation and keeping the purchasing power of the Zambian Kwacha (ZMW) stable.

- Promote financial system stability: This ensures a healthy and functioning banking sector where institutions operate safely and soundly.

- Foster economic growth: The central bank achieves this by influencing interest rates and credit availability, impacting overall economic activity.

A Necessary Evil?

Central banks, like guardians of a nation’s financial well-being, are sometimes forced to enact measures that can feel like a necessary evil. These interventions, while potentially inconvenient, are crucial to preventing damage to the financial system and the broader economy.

A prime example of this role in action is BOZ’s decision to take over Investrust Plc in April 2024 due to the bank’s insolvency. This decisive action underscores the BOZ’s critical responsibility in maintaining financial stability within Zambia.

Why Did BOZ Take Over Investrust?

The Bank of Zambia’s decision to take over Investrust likely stemmed from concerns about the bank’s financial health and its potential impact on the broader financial system. Here are some possible explanations:

- Insolvency

As stated in the BOZ press release, Investrust faced insolvency, meaning it could not meet its financial obligations to creditors. This could be due to a combination of factors such as bad loans, mismanagement, or a decline in deposits. - Loss of Public Confidence

A failing bank can erode public trust in the entire financial system. People might become hesitant to deposit their money, leading to a liquidity crisis and further financial instability. - Domino Effect

The failure of one bank can trigger a domino effect, impacting other institutions that have financial ties with it. Banks in any economy form the monetary system of that economy. One of the central banks’ most important obligations is to protect against systemic failure in the financial sector. In the case of Zambia, BOZ’s intervention might have been aimed at exactly that- preventing a wider financial crisis.

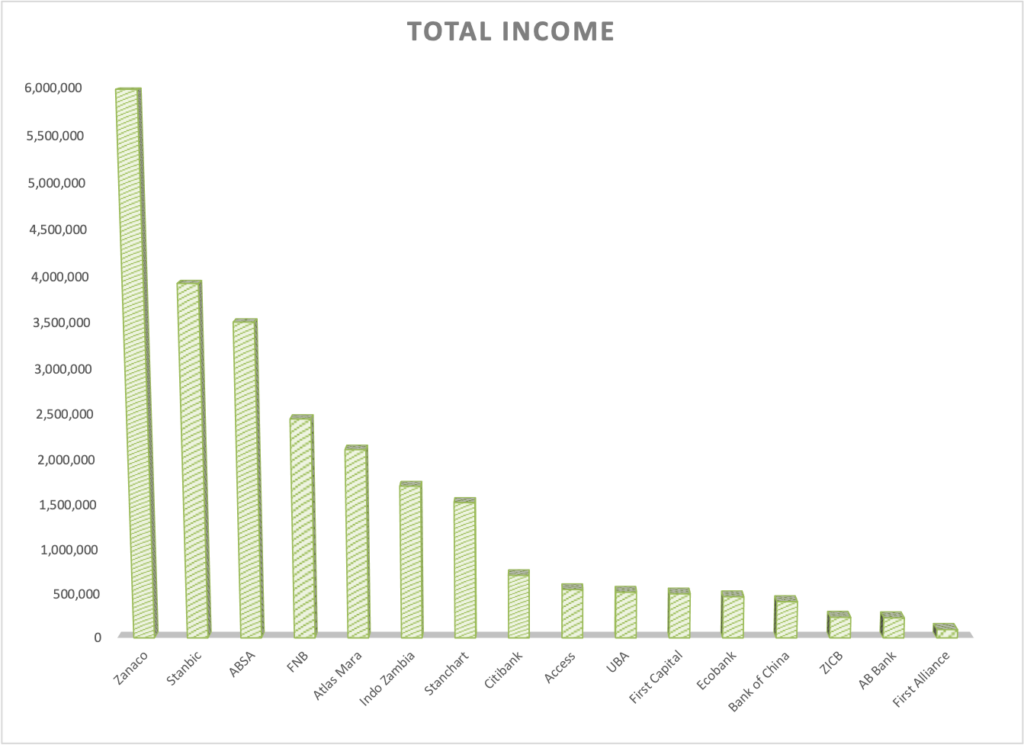

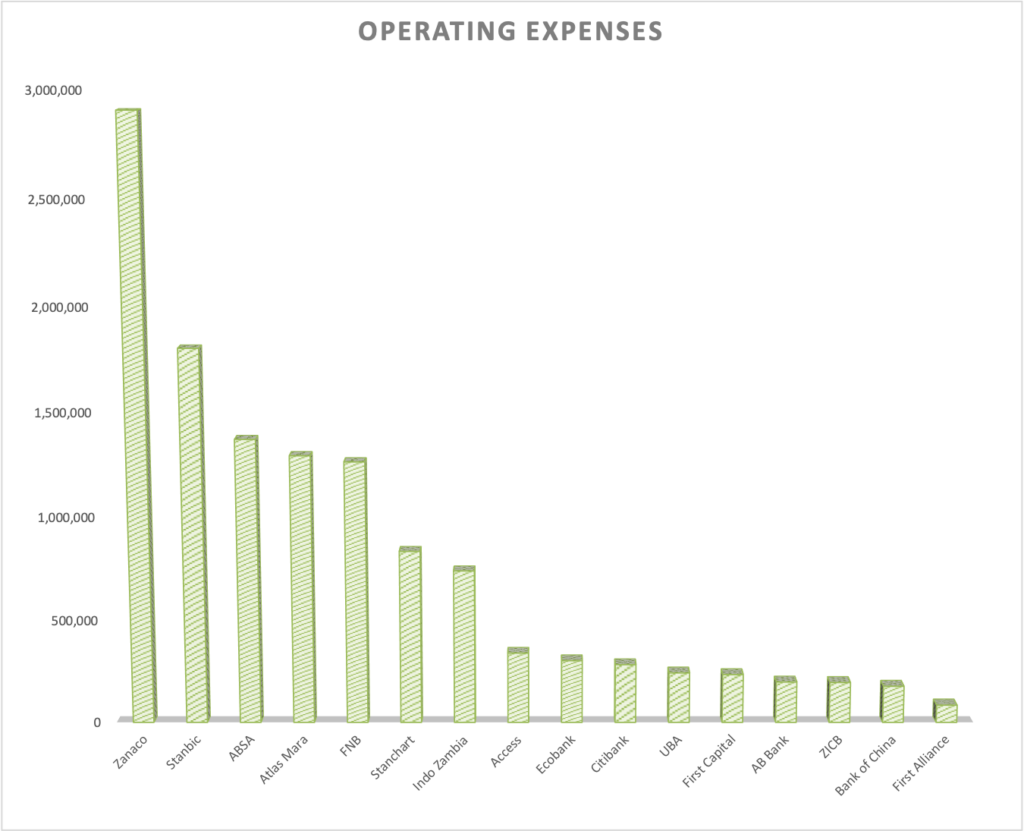

Performance of Zambian Banks in 2023

To understand the context of BOZ’s intervention, it is beneficial to examine the performance of other banks in Zambia over the past year. This can provide insight into the overall health of the banking sector and highlight the contrast with Invest Trust’s challenges.

ZANACO (Zambia National Commercial Bank)

As the largest bank in Zambia, ZANACO demonstrated robust performance in 2023. With an asset value of K45 billion, the bank’s annual report highlighted significant growth in both deposits and loan portfolios. For the year ended 2023, the bank’s total income stood at close to K6 billion with a profit after tax of more than K1.8 billion against an operating expense of K2.9 billion. This performance underscores ZANACO’s stability and strong market position, contributing to overall confidence in the banking sector.

In contrast, AB Bank was the smallest bank in the sector, with an asset value of K871 million. The banks, total income stood at K227 million with an expense of K199 million.

Due to its significant size and stability, ZANACO was appointed by BOZ to facilitate payments to depositors of Investrust Bank, which is in possession. This appointment is likely due to ZANACO’s capacity to handle such a critical task, its robust infrastructure and branch network.

Absence of Data on Investrust

Unfortunately, specific performance data on Investrust for 2023 was not available at the time of analysis. However, the issues leading to BOZ’s intervention suggest that Investrust struggled significantly compared to its peers. Factors likely included poor asset quality, high levels of non-performing loans, and inadequate capital buffers.

Potential Consequences of the Takeover

The takeover will likely have both positive and negative consequences, which may include:

- Protecting Depositors

BOZ’s intervention will no doubt safeguard depositors’ money by preventing a complete bank collapse. In fact, depositors are almost guaranteed that they will receive their money back. - Restoring Confidence

Although that pundits maintain that BOZ should have acted sooner as there were tell-tell signs that the bank was in distress, the central bank’s swift and decisive action has done more to restore public trust in the banking system than anything else. - Disruption for Customers

As far as negative consequences go, Investrust customers have faced unwelcome temporary disruptions as BOZ works to stabilise the bank. - Uncertainty for Employees

The takeover could lead to job losses or changes in employment conditions for Investrust staff.

Raising the Monetary Policy Rate

Another example of the central banks stewardess over the financial and economic landscape of the country is its role in determining the monetary policy rate. On May 15th, 2024, BOZ announced a decision to raise the Monetary Policy Rate (MPR) by 100 basis points, from 12.5 percent to 13.5 percent. This measure is a crucial tool in the central bank’s arsenal to curb inflation and maintain economic stability.

What is the Monetary Policy Rate (MPR)?

The MPR is the interest rate at which the central bank lends to commercial banks. By adjusting this rate, the central bank can influence the amount of money circulating in the economy.

Why is Curbing Inflation Important?

Inflation refers to the general increase in prices over time, eroding purchasing power. As of April 2024, ZAMSTATS reports that the annual inflation rate in Zambia stood at 13.8 percent, meaning that in general, the price level of goods and services increased by 13.8 percent between April 2023 and April 2024.

High inflation is detrimental to an economy for several reasons:

- Reduces Purchasing Power: As prices rise, consumers can buy less with the same amount of money. Thus, if a good cost K100 in April 2023, the same would now cost around K113.8 in April 2024. This is a significant increase, especially since people’s incomes have remained largely unchanged in the same period.

- Creates Uncertainty: Businesses may find it difficult to plan for the future, impacting investments and economic growth.

- Hurts Savings: The real value of savings diminishes as inflation rises, discouraging saving behaviour.

- Increases Cost of Living: For households, higher prices mean higher living costs, which can lead to a decrease in the standard of living.

Impact of Raising the MPR on the Economy

As simple as this may sound, raising or lowering the MPR is not without consequences. These are some of them:

- Access to Credit: Higher interest rates typically result in reduced borrowing. Consumers and businesses may find it more expensive to take out loans, leading to decreased spending and investment.

- Cost of Borrowing: As the cost of borrowing increases, businesses may scale back expansion plans and households might put off big-ticket purchases like homes and cars.

- Control of Inflation: By making borrowing more expensive, the central bank can reduce spending and demand in the economy, which can help lower inflation.

Are There No Other Tools Apart from the MPR?

Certainly. The MPR is just one of the tools in the central bank’s arsenal. While raising the Monetary Policy Rate (MPR) is a powerful tool, BOZ has a toolbox filled with other instruments to influence the economy.

However, the choice of which tool to use or indeed which combination of tools depends on the specific economic outcome that the central bank wants to achieve. Is it low inflation or is the end goal to stimulate growth?

Indeed, the central bank also needs to look at the country’s prevailing economic situation and what impact each tool or combination of tools has on the economy. This underscores why central bank operations need to be independent from government intervention. Read about central bank independence here.

Here’s a glimpse into some of these options.

- Open Market Operations (OMO)

Imagine the BOZ acting like a big player in the government bond market. By buying bonds, they inject money into the economy, potentially lowering interest rates and encouraging borrowing and spending. Conversely, selling bonds absorbs money, potentially raising interest rates and tamping down inflation.

- Reserve Requirements

This lever regulates how much money banks can lend. Think of it as the BOZ adjusting the amount of cash banks need to keep on hand. Increasing reserve requirements reduces lending power, potentially slowing economic growth but also fighting inflation. On the other hand, decreasing them allows banks to lend more, stimulating growth but potentially increasing inflation.

- Quantitative Easing (QE)

This is a big financial bazooka. The BOZ electronically creates new money to buy government bonds or other assets, injecting a significant amount of money into the economy. This is typically used during economic downturns to stimulate borrowing and spending.

- Moral Suasion

Though not as powerful as regulation, the central bank does use an instrument called moral suasion. Moral suasion, in the context of central banking, refers to the practice of using influence and persuasion, rather than regulations or direct intervention, to guide the behaviour of financial institutions. BOZ does this through public statements, private meetings and market signalling.

The Road Ahead

The Bank of Zambia will likely work to:

- Restructure Investrust: This could involve finding a new owner or merging it with another healthy bank.

- Recover Bad Loans: BOZ might attempt to recoup money owed to Investrust to improve its financial health.

- Prevent Future Failures: This takeover serves as a reminder for other banks to maintain strong financial practices.

Conclusion

The Bank of Zambia’s takeover of Investrust Bank highlights its critical role in safeguarding financial stability. While the short-term consequences might be challenging, BOZ’s intervention aims to prevent a wider crisis and foster a healthy financial system for Zambia’s future. It is important to note that this is an ongoing situation, and further details might emerge in the coming days and weeks.

In conclusion, BOZ’s decisive action reflects its mandate to uphold the stability of the financial system. The performance of Zambian banks in 2023, with ZANACO leading in strength and AB Bank showing resilience, contrasts sharply with the troubles at Investrust. This scenario underscores the importance of vigilant regulatory oversight and sound management practices within the banking sector.

The appointment of ZANACO to facilitate payments to Investrust depositors demonstrates the critical role larger, more stable banks play in maintaining overall financial stability. Furthermore, the recent increase in the Monetary Policy Rate underscores BOZ’s commitment to controlling inflation and ensuring economic stability, even if it means tighter access to credit and higher borrowing costs in the short term.

- 13 Life Lessons I Learnt as a Teacher - July 23, 2024

- 13 Life Lessons I Learnt as a Teacher - July 22, 2024

- 13 Life Lessons I Learnt as a Teacher - July 21, 2024

Very educative. Thanks Alex

Thank you for sharing this information! If you need some details about SEO than have a look here Article City